All download history and purchase information can be found in the My Business section of the XNA Creators Club web site. However, in order to get paid, you will need to submit your personal and tax information.

If you are an independent game developer and a non-U.S. based creator then the task of processing your personal and tax information can be very challenging. Therefore, this blog post attempts to shed some light on the process, and ensure payment is made from the sales of Xbox LIVE Indie Games.

Note: I am not a tax advisor; pls do not read the following as defacto or proven advice.

Process

In order to get paid, creators must enter their personal and banking information on the XNA Creators Club web site and submit the relevant Form W-8 tax form to Microsoft.

Note: there are four types of W-8 forms available on the Internal Revenue Service (IRS) web site;

Form W-8BEN is the most frequently submitted form: I will refer to this as Form W-8 from now on.

Independent game developers who are non-U.S. based creators, may be eligible for a reduction or exemption from U.S. income tax on their revenue, provided their country has a tax treaty with the U.S.

If this is the case, then you may be able to take advantage, providing you have a relevant Individual Taxpayer Identification Number (ITIN) and submit a properly completed treaty claim on Form W-8.

It appears this is the most difficult and confusing part of the tax process for independent game developers who are not based in the U.S.:

|

Navigate to the United States Income Tax Treaties page on the IRS web site. If your country is listed then your country has a tax treaty with the U.S.

Decide if you would like to take advantage of the tax treaty

If your country has a tax treaty with the U.S. then you may like to take advantage in order to claim a reduction in U.S. income tax. Therefore, you must apply for an ITIN and submit a properly completed Form W-7 to the IRS.

Note: an ITIN is not strictly required to get paid, although without it you will be subject to an automatic 30% U.S. tax withholding, even if your country provides a lower rate of U.S. taxation.

Important: the process of applying for an ITIN alone can take weeks / months and it is easy for the ITIN application to be rejected by the IRS if Form W-7 is not completed perfectly.

To summarize, in order to get paid, you must complete the following tasks:

|

|

If your country does not have a tax treaty with the U.S., or you decide not to take advantage of the tax treaty, then leave U.S. Tax Identifier blank and check the box. If / when you have obtained an ITIN, you can enter this as the U.S. Tax Identifier and leave the box unchecked accordingly.

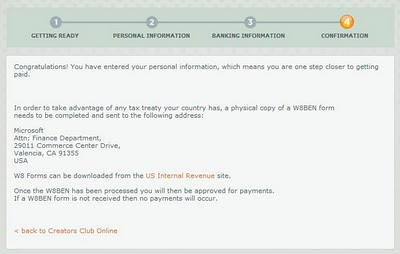

If your country does not have a tax treaty with the U.S., or you decide not to take advantage of the tax treaty, then leave U.S. Tax Identifier blank and check the box. If / when you have obtained an ITIN, you can enter this as the U.S. Tax Identifier and leave the box unchecked accordingly.After entering your personal and banking details, a confirmation panel similar to the following will appear:

The panel states you will now need to submit a physical copy of your Form W-8 tax form to Microsoft.

The panel states you will now need to submit a physical copy of your Form W-8 tax form to Microsoft.The panel may also state which particular Form W-8 tax form you need to send, e.g. Form W-8BEN.

Submit the relevant tax form(s)

When you submit the relevant tax form(s), you have 3x options available:

|

Option 1: you cannot claim a tax treaty with the U.S or you choose not to take advantage of the tax treaty because the effort to obtain an ITIN is too time consuming, too difficult, or you cannot wait.

Complete Form W-8 as per the instructions. There is also an informative post on the XNA Creators Club web site:

|

Microsoft

Attn: Finance Department,

29011 Commerce Center Drive,

Valencia, CA 91355

USA

Submit Form W-7 to obtain ITIN / Submit Form W-8 with ITIN

Option 2: your country has a tax treaty with the U.S. and you would like to take advantage in order to claim a reduction in U.S. income tax.

Download and print the latest Form W-7. Follow the instructions carefully (recommended).

Remember: if Form W-7 is not completed perfectly then your ITIN application will be rejected by the IRS.

Form W-7

As an independent game developer, you will be claiming royalty income from Microsoft. Therefore, a good example on how to complete Form W-7 can be found on Pg. 27 of IRS Publication 1915:

When you check box (a). Nonresident alien required to obtain ITIN to claim tax treaty benefit with a foreign country, also check box (h). Enter "Exception 1(d) – Royalty Income" on the dotted line next to box (h). Also, enter treaty country, which is your country of residence, and treaty article number 12.

When you check box (a). Nonresident alien required to obtain ITIN to claim tax treaty benefit with a foreign country, also check box (h). Enter "Exception 1(d) – Royalty Income" on the dotted line next to box (h). Also, enter treaty country, which is your country of residence, and treaty article number 12.Note: to confirm the correct treaty article number:

|

Documentation: as Microsoft is the withholding agent, you will need to complete and attach the following letter. You will also need to send identification document(s). If you submit an original valid passport (or a notarized or certified copy of a valid passport), then you do not need to submit any other documents.

Send Form W-7, letter from Microsoft, and proof of identity to:

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O.Box 149342

Austin, TX 78714-9342

USA

Once you obtain an ITIN, you can now complete Form W-8 as per option 1. However, this time enter your ITIN on line 6. U.S. taxpayer identification number and check box SSN or ITIN accordingly.

You must also complete Part II Claim of Tax Treaty Benefits: Check box (a). and enter your country on the dotted line. Also, check box (b) as the U.S. taxpayer identification number is stated on line 6.

Finally, on line 10. Special rates and conditions, there is an informative post on the XNA Creators Club web site (excerpt):

The beneficial owner is claiming the provisions of Article 12 of the treaty identified on line 9a above to claim a 0% rate of withholding on (specify type of income): Royalties. Explain the reason the beneficial owner meets the terms of the treaty article: I am a XXXX citizen and resident of XXXX receiving royalties from U.S. source.

Send Form W-8 to:

Microsoft

Attn: Finance Department,

29011 Commerce Center Drive,

Valencia, CA 91355

USA

Submit Form W-8 without ITIN / Submit Form W-7 to obtain ITIN / Submit Form W-8 with ITIN

Option 3: although you can claim a tax treaty benefit, you would like to get paid immediately: Submit Form W-8 without ITIN as per option 1. and ensure payment is made from the sales of Xbox LIVE Indie Games.

Next, submit Form W-7 to obtain ITIN as per option 2. While you ITIN application is being processed, or if your ITIN application is rejected and you need to start over, you will still continue to get paid regardless. When your ITIN is approved, submit Form W-8 with ITIN as per option 2.

Option 4

Finally, if you are new to XNA game development, there may be one other option worth considering: submit Form W-7 immediately. By the time your game is published you would (hopefully) have obtained the ITIN.

Therefore, you could enter your personal and banking information on the XNA Creators Club web site: Enter the ITIN as the U.S. Tax Identifier, leave the 30% U.S. tax withholding box unchecked, and submit Form W-8 with ITIN from the outset.